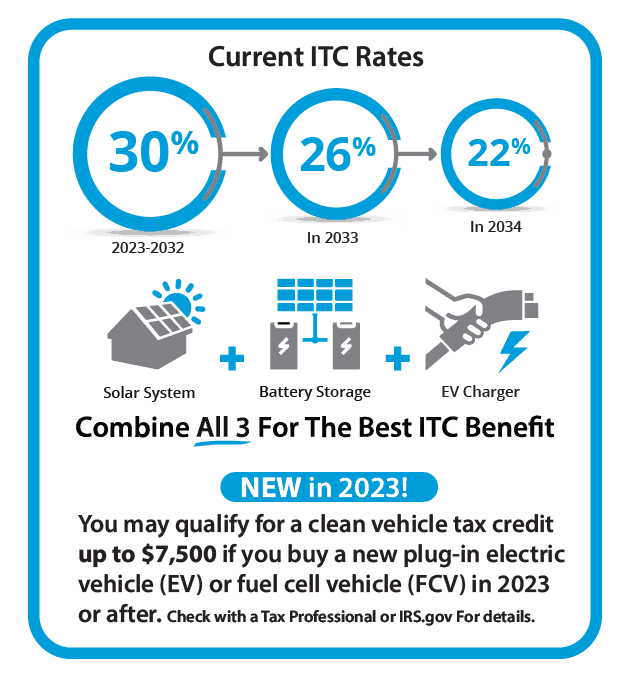

For vehicles placed in service on or after April 18, 2023, the credit amount will depend on the vehicle meeting the critical minerals requirement ($3,750) and/or the battery components requirement ($3,750). A vehicle meeting neither requirement will not be eligible for a credit, a vehicle meeting only one requirement may be eligible for a $3,750 credit, and a vehicle meeting both requirements may be eligible forthe full $7,500 credit.

For vehicles placed in service before or on April 17, 2023, the credit is calculated as a $2,500 base amount plus, for a vehicle which draws propulsion energy from a battery with at least 7 kilowatt hours of capacity, $417, plus an additional $417 for each kilowatt hour of battery capacity in excess of 5 kilowatt hours, up to an additional $5,000 beyond the base amount. In general, the minimum credit amount will be $3,751 ($2,500 + 3 * $417), representing the credit amount for a vehicle with the required minimum of 7 kilowatt hours of battery capacity. Learn more

The credit is nonrefundable, so you can’t get back more on the credit than you owe in taxes. You can’t apply any excess credit to future tax years. Learn more.

For vehicles purchased in 2022 or before, credit eligibility was determined under different criteria.

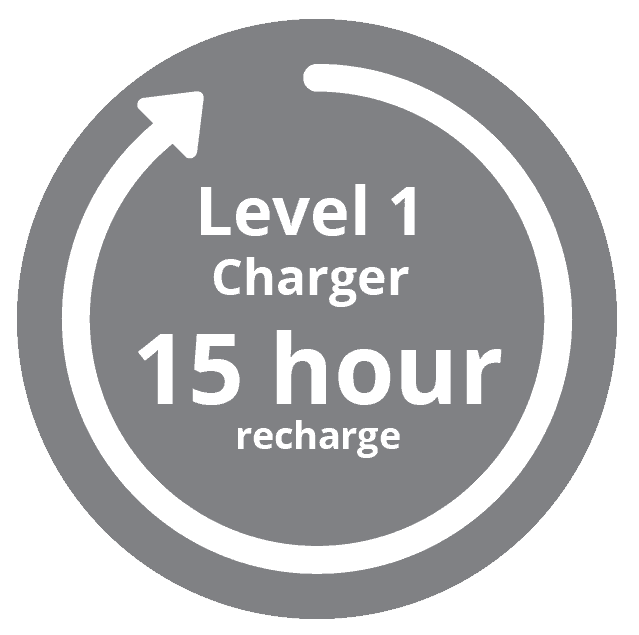

These typically come with your car and are able to be used with your home electric outlets.

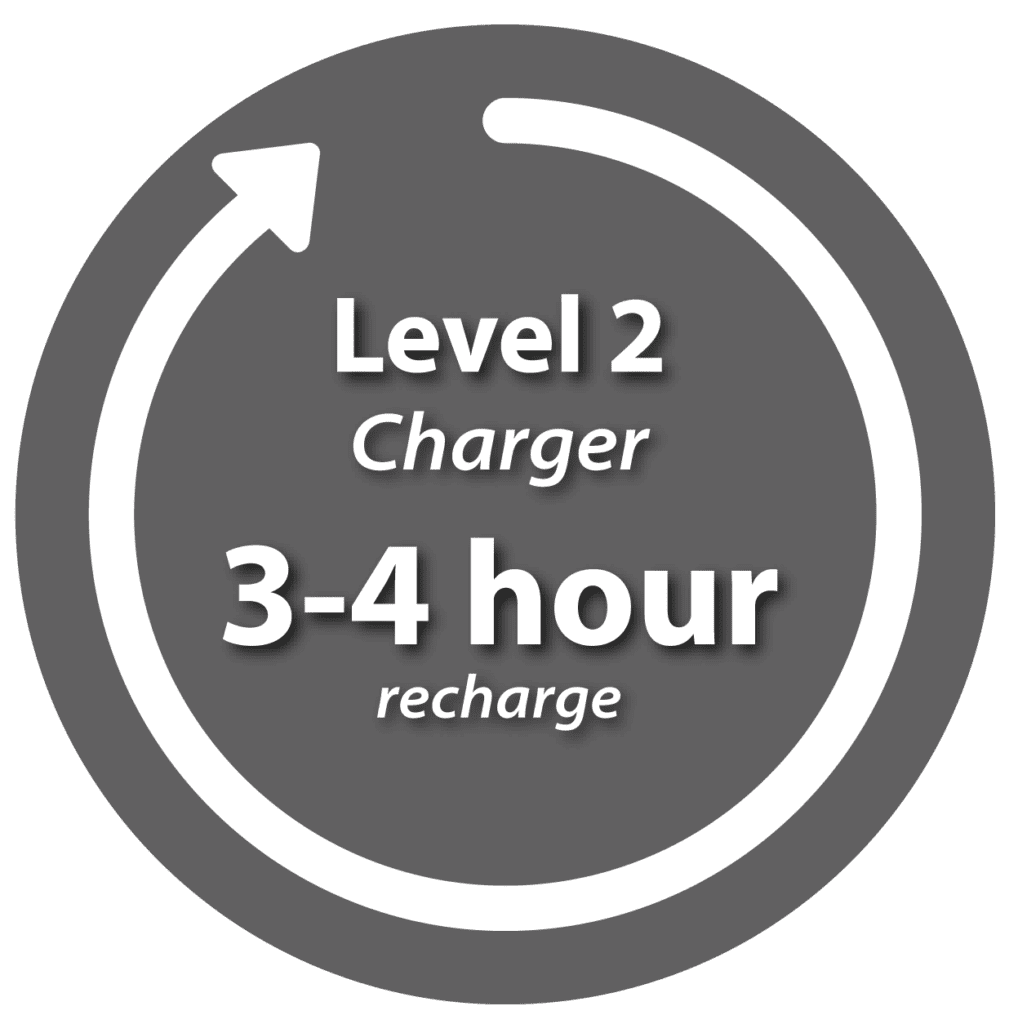

These typically come with your car and are able to be used with your home electric outlets. The charging time is reduced by more than 60% and allows owners to charge at the speed of a public charger conveniently at your own home.

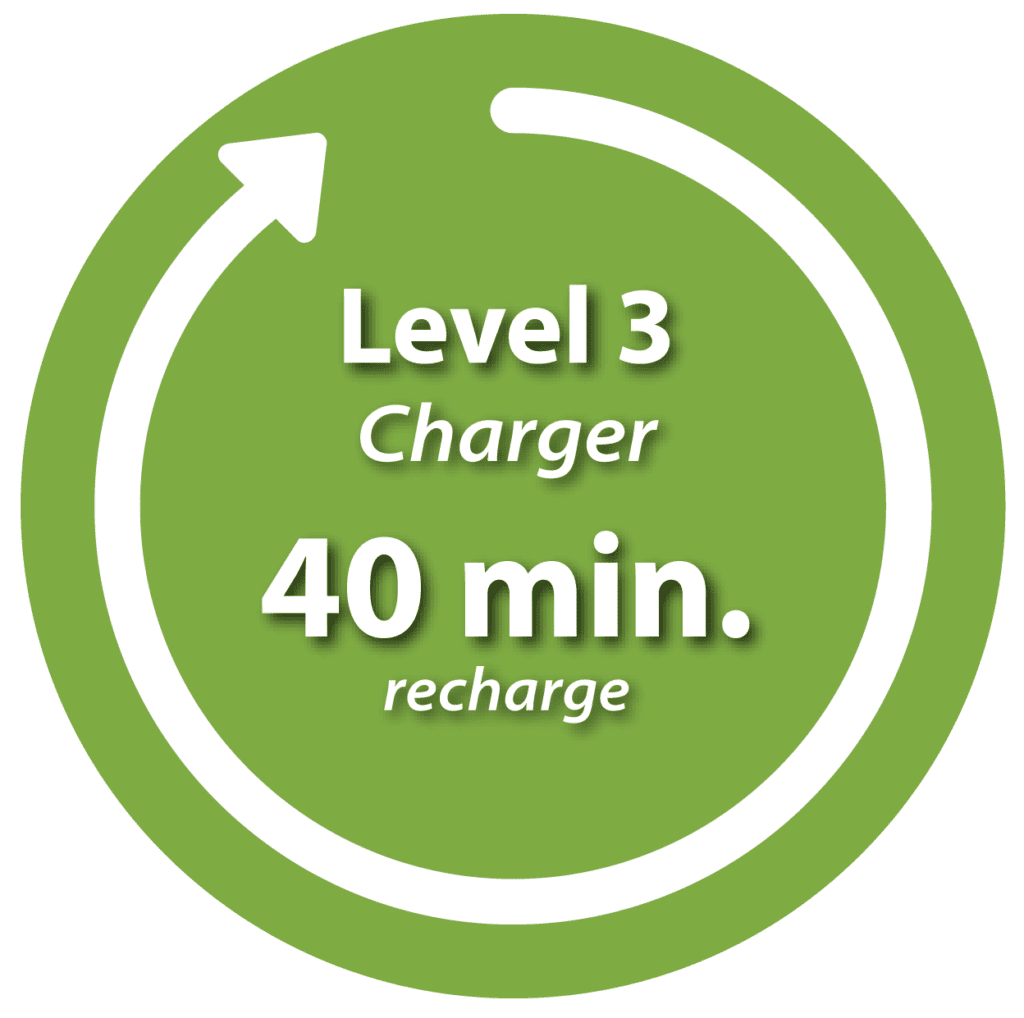

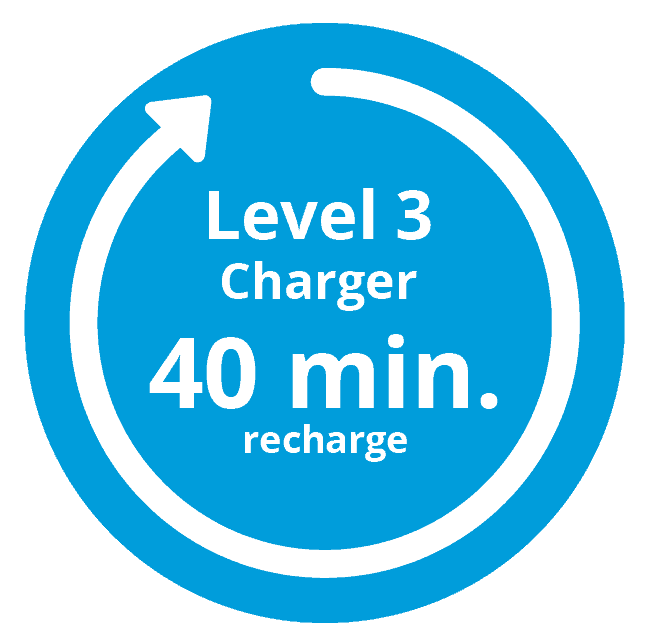

The charging time is reduced by more than 60% and allows owners to charge at the speed of a public charger conveniently at your own home. The cream of the crop! These are the leading edge of the charging technology.

The cream of the crop! These are the leading edge of the charging technology.